Global network

Phenix Capital Group has the largest network in the impact investing space, a global community working with leading impact investing programs.

Our investment consulting supports institutional investors in sourcing suitable impact funds delivering impact and returns.

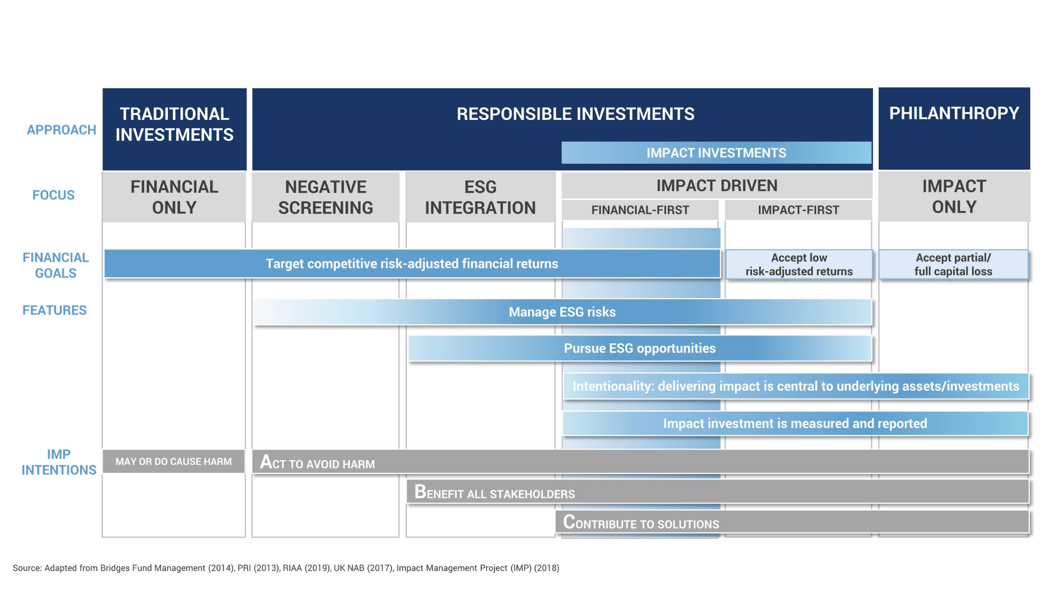

Contact usThe Global Impact Investing Network (GIIN) defines impact investing as an investment approach with the dual mandate of generating financial returns and positive societal or environmental impacts, with the notion of measuring the positive and negative impact of investments, ensuring both intentionality and additionality among these.

Impact investing has yielded new opportunities for institutional investors, fund managers, and service providers while tackling some of humanity’s greatest challenges, such as climate change.

Our Impact Investment Consulting services focus on Financial-First Impact Investments. In this approach, there is no trade-off between return and impact, thus, all funds we work with target competitive risk-adjusted returns.

Phenix Capital Group has the largest network in the impact investing space, a global community working with leading impact investing programs.

Our Impact Investment Consulting team works with your team, complementing your fund selection capacities, and considering possibilities across all asset classes, from Private to Public markets.

Phenix Capital group's advice is made using data from our Impact Database, which has been tracking impact funds worldwide through the years.

Our impact investing experts bring different perspectives to our services, making it easier to consider several angles and approaches.

Phenix Capital Group has powered many of the largest institutional investors in the world with its Impact Investment Consulting related services.

"Phenix Capital Group has been appointed to achieve the impact target of 1% allocation and guide us in the selection process. Thanks to their extensive impact database, based on contributions to the SDGs, they have the opportunity to screen the impact offers for impact investments that are suitable for Pensioenfonds Detailhandel. Thanks to their experience with the impact market, knowledge about the managers and due diligence capacity, they were well-equipped to guide us in the selection process.

Henk Groot, Head of Investments at Pensioenfonds Detailhandel

A Dutch pension fund with approximately 32 billion euros in invested assets.

Phenix Capital Group's investment consulting shaped an SDG-aligned 300 million impact investment portfolio for Pensioenfonds Detailhandel, a large Dutch pension fund with more than 1.3 million participants and approximately 32 billion euros in invested assets.

Pensionfund Detailhandel had the ambition to advance their target SDGs allocating 1% of their portfolio to 'direct impact' - in private markets impact investments.

In line with their beneficiaries’ preferences, the portfolio supports the Sustainable Development Goals (SDGs) and prioritizes:

.png?width=529&height=132&name=SDGs%20detailhandel%20(600%20%C3%97%20150%20px).png)

Learn more by downloading the case study.

Our impact investment consulting team has access to cutting-edge market intelligence and a strong track record in providing impact investment consulting and advisory services to institutional investors, helping them to reach a positive impact and returns.

The building blocks of our Impact Investment Consulting service:

Discover

Solutions mapped for you

Create a market map of the most appropriate impact investment solutions for you, attending your needs across asset classes, geographies and themes.

We also offer model portfolios and white-label products across themes and asset classes, if that is your preferred approach.

Start selecting

With your criteria

Considering your impact criteria, our impact investing consulting team will make use of sophisticated impact measurement frameworks and benchmarks to perform investment and impact due diligence for fund manager selection across all asset classes.

Our expertise includes advice for tax-efficient fund placement.

Ongoing process

The investment cycle

In order to deliver the best impact investing advisory services for institutional investors, our impact investment consulting and advisory team provides ongoing impact reporting, monitoring and review of processes across the investment cycle.

MARKET RESEARCHES, FUND LANDSCAPES AND BOARD PRESENTATIONS

Through our extensive market intelligence, we can help institutional investors make more informed decisions, get answers to their questions related to available opportunities in the impact market, and base analysis on our in-house data.

We have provided insights to various pension fund boards, specific to certain impact themes and/or asset classes and where necessary, provided an overview of the impact investing industry, including examples of funds and underlying investments.

MANAGER SELECTION AND OUTSOURCED IMPACT DUE DILIGENCE

Phenix Capital Group can be a valuable partner to investors in this phase, providing real-time information on impact funds and managers pre-screened to fit the definition of financial-first impact investments.

Phenix Capital lends investors its intelligence of the universe of funds as well as its deep understanding of fund selection, to ensure funds have robust teams, strategies, track records, and impact processes.

IMPACT MEASUREMENT, MANAGEMENT AND REPORTING

Our Impact Measurement and Management division helps investors identify areas of improvement in their funds and works directly with fund managers to support the implementation of the suggested practices.

Additionally, through the extensive mapping of fund managers and collection of impact reports, Phenix Capital Group can support the portfolio-level aggregation of fund impact data.

Let's explore the investable impact universe together, designing your impact investing portfolio, selecting funds and implementing your impact investment cycle for positive impact and returns.

Don’t hesitate to connect with us if you have questions.

Schedule a call