NEWS: tale of two markets: Public-markets ESG funds roar, private-market impact funds struggle

Investors continue to pour billions into sustainability-themed stock funds, making “ESG” one of the hottest trends in asset management. But new...

.jpg)

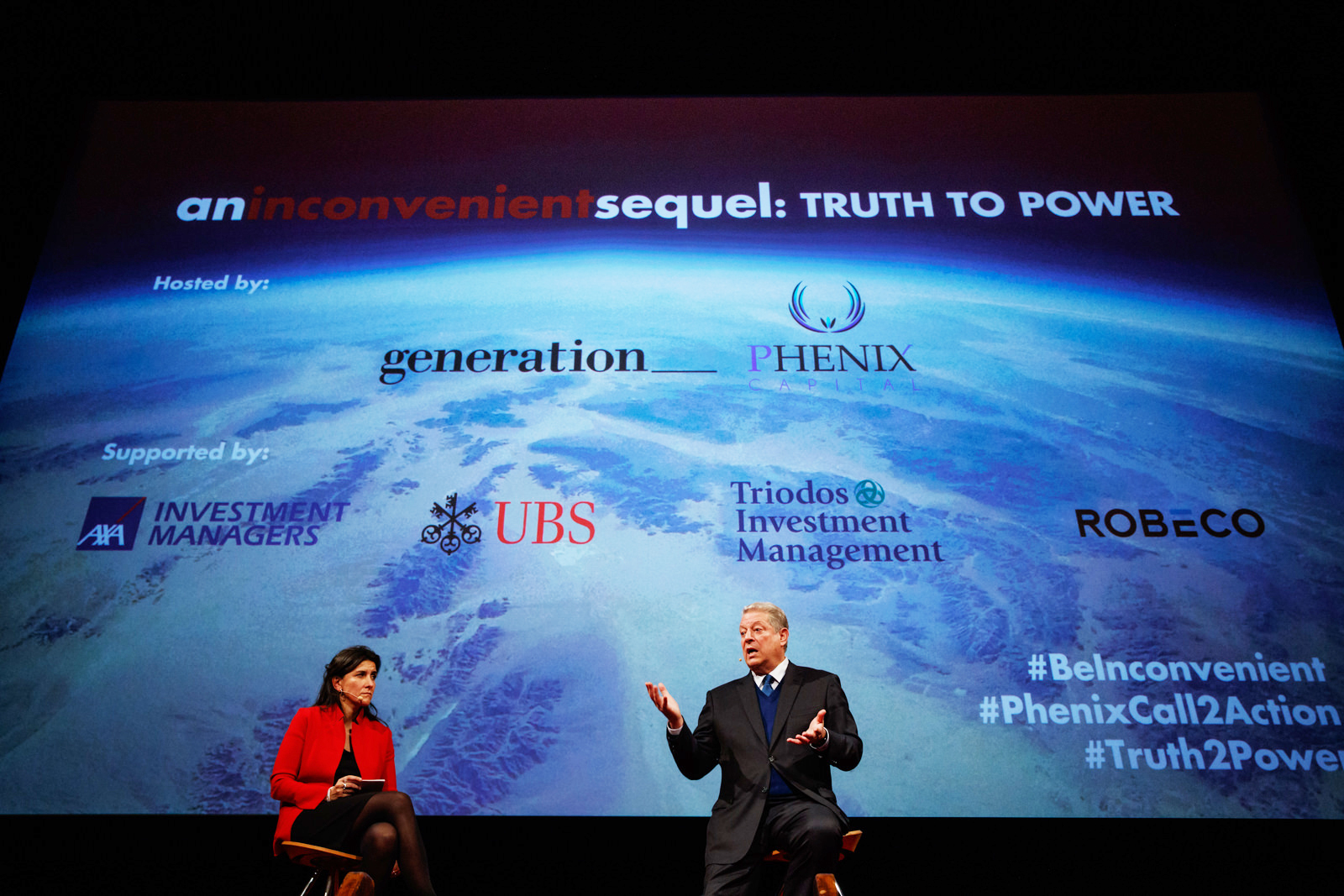

More than 10 years after climate change documentary Inconvenient Truth, Phenix Capital, a leading European impact investing consultant, hosted a private screening of the sequel: An Inconvenient Sequel: Truth to Power for nearly 500 European institutional investors.

This was followed by a Q&A session with Al Gore, moderated by Sophie Robé, founder and managing director of Phenix Capital in Amsterdam.

“The film was a powerful reminder that the climate is changing irrevocably. Today, it is an institutional investor’s fiduciary duty to take externalities such as climate change into consideration in the investment decision-making process,” said Sophie Robé.

“We were honoured to have former Vice President Al Gore join us to take this discussion to the next level,” said Dirk Meuleman, managing director of Phenix Capital. “Investing sustainably is no longer just an ESG risk management exercise but an opportunity to add long-term returns to an investor’s portfolio now that there are an increasing number of high impact solutions available”.

The event, held at the Pathé Tuschinski in Amsterdam, was organised by Phenix Capital and Generation Investment Management and supported by Axa Investment Managers, Robeco, Triodos Investment Management and UBS asset Management.

The day-long programme included a small private lunch with Al Gore and a high-level institutional investor round-table discussion on the risks, challenges and opportunities for investing in climate solutions along the UN’s Sustainable Development Goals.

Ends

Photo credits: JACQUELINE DERSJANT - PHTGRPHR

Phenix Capital

Phenix Capital is a leading European investment consultancy advising institutional investors on impact investing. Based in Amsterdam, Phenix Capital supports investors by designing impact and sustainable development strategies; sourcing scalable impact investment opportunities from its proprietary database; and measuring and reporting impact and contribution to the UN’s Sustainable Development Goals (SDGs).

Impact Summit Europe 2018, The Hague, 20-21 March 2018

The Impact Summit Europe is an investor-only impact investment conference that aims to catalyse private institutional capital to support the financing of the UN’s Sustainable Development Goals (SDGs). Over two days, asset owners and institutional investors share knowledge, exchange best practices, network and challenge each other.

Investors continue to pour billions into sustainability-themed stock funds, making “ESG” one of the hottest trends in asset management. But new...

By Mohit Saini, Phenix Capital Group & Nao Sudo, Impact Frontiers