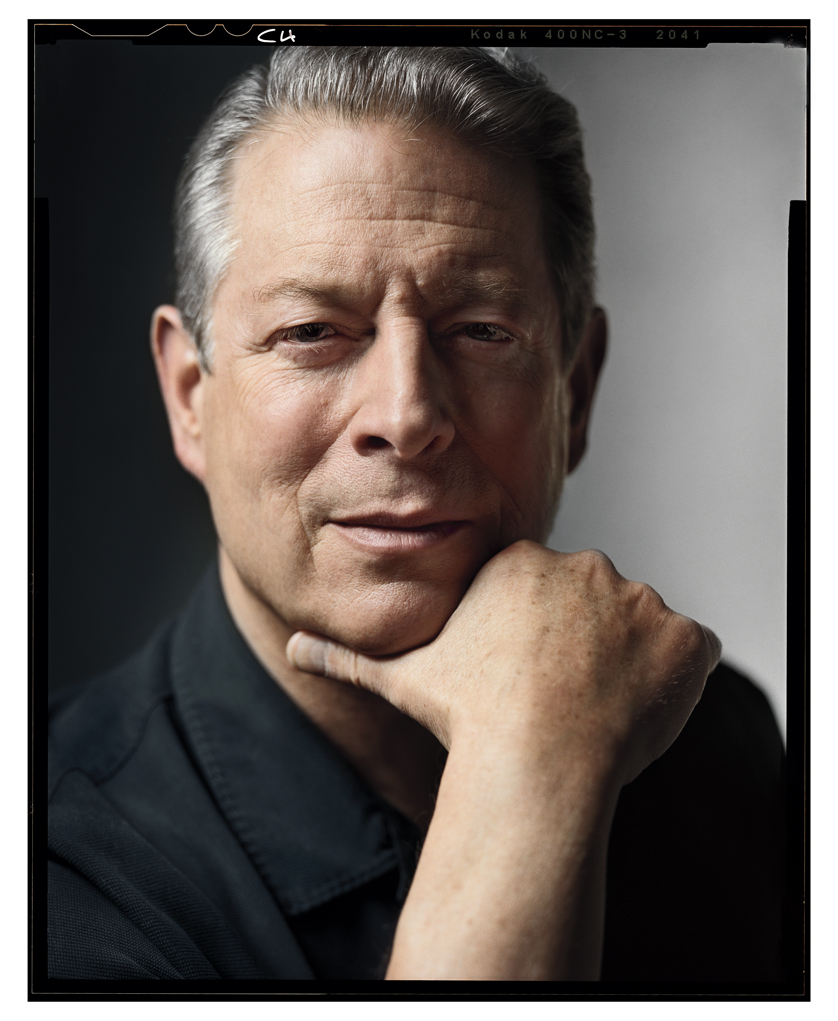

Al Gore keynote speaker at Impact Summit Europe 2017

During the third edition of the Impact Summit Europe on March 21st, Al Gore will share his vision on sustainable investing at the Peace Palace in The...

3 min read

Phenix Capital May 17, 2017 3:47:01 PM

Fighting Climate Change is more urgent than ever and we at Phenix Capital are doing our best to draw attention to the gravity of this movement. On 21st and 22nd of March 2017, Phenix Capital convened the third edition of Impact Summit Europe, an impact investing conference that aims to catalyze private institutional capital to support the financing and mainstreaming of impact and SDG investing. We believe that the United Nations Sustainable Development Goals provide a universal monitoring framework for identifying and measuring the impact of decisions and investments (institutional) investors make.

The key focus of Impact Summit Europe this year was on ‘Climate change’, directly linked to the SDGs “#7-Affordable and clean energy” and “#13-Climate action”. We were honoured to have former U.S. Vice President and Nobel prize laureate Al Gore as keynote speaker making a case for mobilizing private capital to fight climate change. Here are some key takeaways from his keynote address:

The inconvenient truth about the climate crisis

Mr. Gore began his climate change narrative with a meticulous array of inconvenient truths –several scientifically proven factual statements stemming from his Oscar winning movie ‘An Inconvenient Truth’. He explains how climate change works and what its direct and indirect ‘systemic’ consequences are - floods, hurricanes, droughts, mega fires, heat waves, famines, bacterial infections, pollution, refugee crisis - to name a few.

Look beyond the visible spectrum to strengthen fiduciary responsibility

To revive a visibly deflated audience, Mr. Gore then moved on to the silver lining -the call for action. How can the financial sector help turn tables around on climate change and alleviate the damage it has caused? A fundamental problem lies in the way we define corporate growth. By looking ‘beyond the visible spectrum’ of financial data and taking into account the environmental and social impact of corporate activity, a more holistic picture of a firm’s sustainable profitability appears, bringing about better-informed investment choices in line with fiduciary responsibility. ‘Sustainable capitalism’ is no longer an oxymoron.

Al Gore during Impact Summit Europe 2017

Be a part of the Sustainability Revolution

The Sustainability Revolution is the most powerful revolutionary change the civilization has yet gone through, taking the scale and magnitude of the industrial revolution and the speed of the digital revolution, and it is happening very quickly. Being still in early stages, the Sustainability Revolution presents tremendous investment opportunities– notably in sustainable solutions related to agriculture, forestry, transportation and power generation.

Call for Climate Action

Globalization has been a centrifugal force in driving change and advancing the global shared project of climate action. To gain a common ground with European investors and discuss the crucial role the private sector can play in leading the Sustainability Revolution and fighting climate change, Al Gore participated in several roundtables in an intimate setting with C-suite executives of pension funds, insurances and asset managers with combined AUM amounting to more than 1.5 trillion euros. The conversations took place in parallel to the summit with executives from pension funds/administrators ABP, Alecta, APG, MN, PFZW, PGGM, PME, PMT, PPF APG, Railways Pension Fund UK and Univest (Photo 1); insurances Achmea, ACTIAM N.V, Aegon, a.s.r. Group Asset Management, NN IP and Storebrand (Photo 2).

A month down the line, 217 institutional investors representing more than USD 15 trillion in assets have written to the governments of the G7 and G20 nations, urging to combine forces and mitigate climate change. We are happy to see Al Gore roundtable participants ABP, ACTIAM N.V., Aegon, Alecta, APG asset management, PPF APG, MN, NN IP, PME, PMT and Storebrand among the signatories.

Phenix Capital has also signed the letter and stands committed to fight climate change. In a nutshell, the call to action touches on three key points:

● Continue to support and implement the Paris Agreement

● Drive investment into the low carbon transition

● Implement climate-related financial reporting frameworks

We would like to encourage our (institutional) investor network to join this movement and sign the letter.

The final deadline to sign the letter is June 30, 2017. Contact AIGCC, CDP, Ceres, IGCC, IIGCC or PRI for more details.

‘Things take longer to happen than you think they will, but then they take faster to happen than you thought they could’. As Al Gore points out, that’s where the climate movement is.

The Sustainability Revolution will happen, because ‘a will to change is in itself a renewable resource’. Sign the letter now and be a part of the solution!

During the third edition of the Impact Summit Europe on March 21st, Al Gore will share his vision on sustainable investing at the Peace Palace in The...

As one of the first organisations having gone through the full Phenix Impact Fund Assessment process, Melchior de Muralt and Dominique Habegger from...

Momentum is gathering pace within European institutional investors as they are increasingly committing money to impact and SDG financing. Europe, led...