REPORTAGE: IPE - Phenix Capital Group: Measuring the market

A new report by Amsterdam-based Phenix Capital Group measuring the market runs the rule over the growing marketplace for impact funds. For reading...

5 min read

Phenix Capital Jun 29, 2018 2:20:39 PM

One of the key themes discussed at the 4th annual Impact Summit Europe 2018, held in The Hague in March, was the emerging markets. The second day of the conference saw Dr. Mark Mobius, a 40-year industry veteran, who has recently launched his own asset management firm, making a case for frontier and emerging markets.

Dr. Mobius’ keynote address was followed by a panel session called High Noon: Are the emerging markets the impact investor’s holy grail? Afterwards, Katherine Brown, head of sustainable and impact investing at the World Economic Forum and Dirk Meuleman, managing director at Phenix Capital, moderated two one-hour product workshops on how to create the ‘perfect’ emerging markets product.

The outcome of the discussion between Kay Parlies, senior economist at the European Commission, Steve van Weede, managing director at Enclude Holding, Sylvia Wisniwski, managing director at Finance in Motion and Bosworth Monck, global head of client relations at the IFC Asset Management Company, without attribution has been summarised in Closing the SDG GAP: The need for public/private collaboration.

The big story is the internet. The biggest most populated countries in the world are now consuming more and more online – Mark Mobius

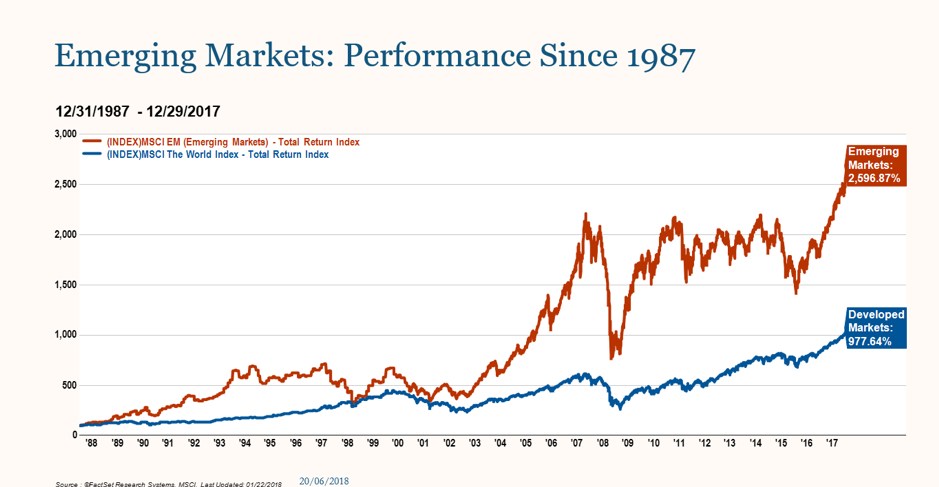

“This chart (below) tells the story of why people invest in emerging markets. Since 1987 when the index was first formulated by the MSCI, you can see emerging markets have generated far, far greater returns than the developed market countries,” said Mark Mobius, founding partner of Mobius Capital Partners.

Source: @FactSet Research System. MSCI. Last Updated: 22/01/2018

“Of course, there has been a lot of volatility, and in 2007 was an incredible boom market. [After the crash of 2008] you can see the tremendous recovery. So there has been volatility, there is no question about it, but the changes have been incredible.

“If you look at where we were in 1987 when we started the very first emerging markets fund, we had six markets to invest in. Today, there are 70 countries around world categorised as Frontier or Emerging. It is amazing. Shanghai 25 years ago, farmland in Pudong - if you've been to Shanghai you know the Pudong area now.

“The next exciting destinations are the frontier markets. If you look at the average GDP growth in the world’s 10 fastest growing countries you will see that between 2012 and 2016, they had an average growth that is much higher than the developed countries. Of these countries, all are emerging markets and eight are frontier. A number of them - Ethiopia, Ivory Coast, Congo, Tanzania, Rwanda - are African, and growing at an incredible pace. So, this presents a significant opportunity, in our view.

“Emerging markets are now becoming much more important. Back in 1987, you saw that the percent of the world market capitalisation of emerging markets was about 3%. Today, it is over 25% and likely to continue increasing. If you look at the market cap, it has been incredible the way these markets have grown.

“As I mentioned, it has gone from six to over 70 markets around the world. If you look at exports, imports and GDP, in 1987 it was between 18% to 24%. Now, it is well over 40%, 42% - 47%. In fact, the latest figures are probably about 50%. So, half of the world’s wealth, growth, imports, and exports are in emerging markets.

“Further good news is that these countries have gotten fiscally stronger. In other words, their government finances have improved dramatically. In 1995, you can see developed markets had more foreign reserves than emerging countries. Today, it is the other way around.

“Now, of course about $3 billon of that $7 billion is China, but the rest is in other emerging countries. If you look a public debt, emerging markets debt as a percentage GDP, is much lower than the developed countries. And if you look at private debt as a percentage GDP, you can see that emerging markets is also lower than developed markets.

Growth in the developed markets is about 2%, while around 4.3% in the emerging countries and that is reflected in company’s earnings. We also see a so-called demographic dividend for emerging markets. Why? Because there are more people in emerging markets. You have got 1 billion people in India and, 1 billion people in China. Overall, 1.4 billion in developed countries versus 5.9 billion in emerging countries.

It is very important to look at the median age for emerging markets, as it is lower than developed. In Frontier markets median age is even lower still. So, you have a population that is just entering the most productive years of their lives, which is the most exciting thing about these countries.

Land mass. If you look at the land mass in these countries, it's much greater than the developed countries. That means more mineral and agricultural resources. And of course, if you have a map of Africa and you try to place the United States, China and a number of other countries, you can fit them all into the continent.

Undervalued currencies. A lot of people think of currency risk when considering investing in emerging markets. Since 2016, emerging countries' performance have been much better than the US dollar. And if you look at the changes, you can see that Russian Ruble has actually appreciated from its bottom by over 40%. The same thing is true of the Brazilian Real and the South African Rand.

Commodities. Some people have taken a negative view on commodities recently but the reality is that prices are beginning to recover very strongly. This is good for some emerging countries. Crude oil, from its bottom in February 2016, has gone up by over 90%. Palladium is also one of my favorites, because most of the cars produced in China still are gasoline powered and of course you need palladium as a catalyst for converters to prevent pollution.

The price of other commodities has also come up quite dramatically. One of the misunderstandings that people have is that China, as one example, is reducing its imports of commodities. If you look at iron ore value, you can see that the value seems to be coming down but if you look at the quantity, you can see it is continuously going up. We are now beginning to see India with one billion people, having to build significant amount of infrastructure and more and more of these commodities will have to be imported or produced locally.

Another thing that people are afraid of is rising interest rates, particularly in the United States. They think that if interest rates go up, the market will go down. The reality is that there is no correlation. Sometimes the Fed rate goes up and the emerging market goes up. Sometimes it goes the opposite way of what you would expect.

The big story is the internet. If you look at the use of the internet globally, you will see China represents 21% of the total and India 14%. The biggest and most populated countries in the world are now consuming more and more online.

This has been achievable through the use of smartphones. Remember the regular Nokia phones? No pictures, no internet, just a phone. Now with the smartphone you can do everything. You can take pictures, you can get apps. In 2008, about 100 million smartphones were sold. This year, it will probably be well over 1.4 billion smartphones sold and 70% of those are in emerging countries.

As just as an example, on ‘singles day’ in China—11/11, the eleventh day of the eleventh month—in one day one company, Alibaba sold $25.3 billion worth of smartphones. In the US, Thanksgiving, Black Monday, Cyber Monday, about $19.6 billion for all vendors. You can see this incredible impact in the emerging countries, particularly in China and now in India.

We have had some bad times in emerging markets. In fact, the three years before 2016 there was net outflow of money from emerging market funds.

But if you look at the long-term picture, there have been bear markets, when the market went down more than 30%. On the average the bull markets went up by about 356%, lasted an average of 69 months, the bear markets went down by about 51% and lasted an average of 15 months. So, what can you conclude from this? Bull markets last longer than the bear markets in the emerging markets. Bull markets go up more than bear markets go down.

A new report by Amsterdam-based Phenix Capital Group measuring the market runs the rule over the growing marketplace for impact funds. For reading...

-1.png)

Amsterdam, April 29, 2021: Phenix Capital has today released its Impact Report: Deep Dive on Emerging Market Funds. The report highlights that total...

.png)

Amsterdam, April 10, 2020: Our team at Phenix Capital are thrilled to announce that the 2020 Global Impact Platform Fund Report: A market map for...