Changing Climate: from risk to opportunity

Author: Niki Natarajan, Communications Advisor, Phenix Capital

4 min read

Phenix Capital Jul 17, 2018 10:01:07 AM

Author: Niki Natarajan, Communications Advisor, Phenix Capital

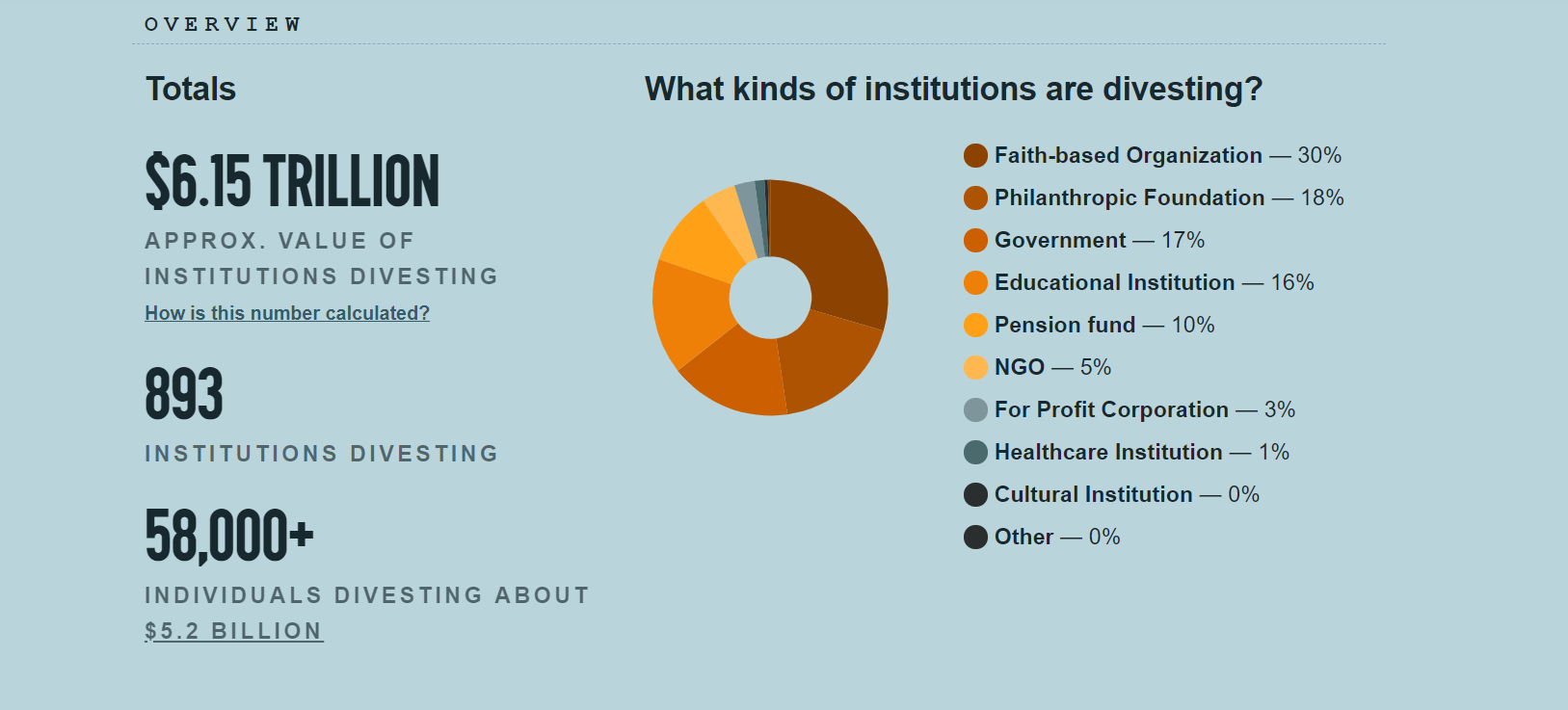

Pension funds, university endowments, foundations, insurance companies, cities, such as New York State, and faith-based organisations globally are all part of a fossil fuel company divestment movement that began on university campuses in the US in 2011. The value of the 893 institutions divesting is $6.15 trillion and more than 58,000 individuals are divesting some $5.2 billion, according to Go Fossil Free.

Last week, the Republic of Ireland became the world’s first country to agree to sell off its investment in fossil fuel companies as part of its decarbonisation process in line with its climate change commitments under Article 2 of the Paris Agreement. Ireland passed the Fossil Fuel Divestment Bill that instructs the National Treasury Management Agency to sell more than €300 million in coal, oil, gas and peat “as soon as is practicable” from the Irish state’s €8 billion Strategic Investment Fund.

Both Ireland and New York City’s $189 billion New York State Common Retirement Fund, which plans to divest $5 billion from fossil fuels, aim to achieve their divestments over a five-year period. Meanwhile, Glasgow University was the first university in Europe to elect to divest from fossil fuel stocks in 2014, kicking off a UK movement that has now seen more than 60 endowments, including Cambridge University most recently, follow suit. The £3 billion Cambridge endowment fund, which has joined the ranks of Oxford, Edinburgh, Sussex and Bristol in their move to tackle climate change, was not originally planning to take this route.

Divestment is not just rife among the UK’s academic institutions. Denmark’s €15 billion MP Pension, the pension fund for public sector university and secondary school staff, also announced earlier this year that it would be excluding all fossil fuel related companies from its portfolio to make sure that its investment policy supported the 2015 Paris Climate Agreement.

As a country, Denmark has plans to make wind drive its fossil fuel ambitions as a country by 2050, creating new investment opportunities for investors in clean technology. Intentional Endowments Network’s white paper for campuses and endowments on Investing in Clean Energy discusses the investment options for university endowments.

In the US, this universe has more than $528 billion in assets, the ability to make illiquid investments, and long-term investment horizons, putting them in a unique position to finance clean energy investments. In the white paper, the authors include snapshots of a few institutions including American University, George Washington University, Arizona State University, Green Mountain College, Luther College, Northeastern University, The University of California System, The University of North Carolina- Chapel Hill, and Yale University, that are leaders in driving the clean energy economy forward through their investments on and off campus.

The fossil fuel divestment movement accelerated after two key events in 2015: Pope Francis’ Encyclical Letter Laudato Si, on Global Environmental Risks and the Future of Humanity in June; and the Paris Climate Agreement in December 2015. The value of assets pledged for divestment totalled more than $5 trillion at the end of 2016, doubling the value pledged 15 months previously, according to Arabella Advisors’ Global Divestment Report.

On 4 October 2017, the feast of St. Francis of Assisi, the Italian diocese and 40 other catholic institution from 11 countries on five continents announced their plans to make the largest ever faith-based divestment, in a faith-based move that was coordinated by the Global Catholic Climate Movement.

Even institutions, such as John D Rockefeller in the US, which have made their wealth in oil are divesting. But for some investors, however, divestment is more about business and investment risk reduction than environmentalism.

Source: www.gofossilfree.org

Indeed, in Europe, the Norwegian central bank, which manages the $1 trillion oil fund, wrote a letter to Norway’s finance ministry proposing the removal of oil and gas stocks from the Government Pension Fund Global’s benchmark index to make the government’s wealth less vulnerable to a permanent drop in oil and gas.

“This advice is based exclusively on financial arguments and the analyses of the government’s total oil and gas exposure and does not reflect any particular view of future movements in the oil and gas sector,” said Deputy Governor Egil Matsen, in the letter.

But while divestment is one way towards saving the planet, many socially responsible investors are now focusing on ways to make market rate returns through more positive allocations. AXA, for example, is not only divesting from coal businesses, but will no longer insure any new coal construction projects and will stop insuring the main oil sands and the associated pipeline businesses.

AXA’s strategy includes divesting from companies that derive more than 30% of their revenues from coal, have a coal-based energy mix that exceeds 30%, actively build new coal plants, or produce more than 20 million tonnes of coal per year to reach €2.4 billion. Moreover, in a positive impact investment strategy, AXA is increasing its green investments to reach €12 billion by 2020.

In fact, the desire to understand how to invest to both save the planet and produce market rate or above returns, is becoming increasingly paramount for those institutions whose beneficiaries cannot afford to be solely philanthropic but still want their investments to be aligned to their values.

Sophie Robé, CFA of Phenix Capital believes that impact investing is the solution. “Fossil fuel divestment is a big step in the right direction, but it is a negative action or exclusion. If everyone pulls out of fossil fuel stocks, then the value of those stocks goes down, so some investors might be pulling out of fossil fuel stocks for reasons other than climate concerns”.

The Intentional Endowments Network’s white paper Investing in Clean Energy puts forward a compelling case of the financial and societal benefits of clean energy investments showcasing another way to commit to climate change. “In 2015, renewable energy attracted $329 billion in global investments, the cost of solar photovoltaics has dropped 80% since 2008, and wind is already the cheapest form of power in some parts of the United States…. Despite market volatility, new investment in clean energy across all asset classes has grown from $62 billion in 2004 to a record $349 billion in 2015,” the report stated.

For many investors, however, the desire to invest with the welfare of the planet is stymied by the ability to find, measure and monitor suitable investments. Focusing on clean energy, the white paper looks at direct ownership, asset leasing, retail power purchase, renewable energy credit purchase, power purchase agreements, green revolving funds, and public or private market investments.

“We truly believe that the next phase in the sustainable investing evolution is impact investing, where by investors can invest in public or private markets to find positive impact stocks and funds that are aligned with their mandate,” says Robé, whose firm also runs impact investing summits globally. Impact Summit America will be held in San Francisco on 11 September 2018.

Author: Niki Natarajan, Communications Advisor, Phenix Capital

.png)

Amsterdam, January 31, 2023: Phenix Capital Group has released today its Impact Fund Universe Report 2023, which reveals that impact investing is a...

New impact report on EU vs US Impact Investing Market.