Training for Success – What sustainability leaders can learn from the Olympic mindset

The second in a series of blogs from Belissa Rojas, ESG and Impact Chief, FAM & Gemma Roex, IMM Lead, Phenix Capital Group

The Four Faces of Impact: Which Manager Are You?

Imagine an institutional investor evaluating potential funds for investment. After extensive due diligence, they shortlist three funds that offer comparable risk-adjusted financial returns, along with robust impact practices and high impact potential.

To assess impact performance, the investor reviews fund managers' latest impact reports—if available—only to find inconsistent structures and content. Some reports read like promotional materials, filled with compelling stories, while others take a data-heavy, accounting-like approach to impact metrics.

With each manager interpreting and communicating impact in their own way, how can the investor decide which fund to invest in?

An experienced investor with in-house impact expertise is likely to conduct impact due diligence and make the investment decisions directly. In other cases—more common in practice— investors often rely on an impact partner to evaluate the fund’s impact considerations and performance.

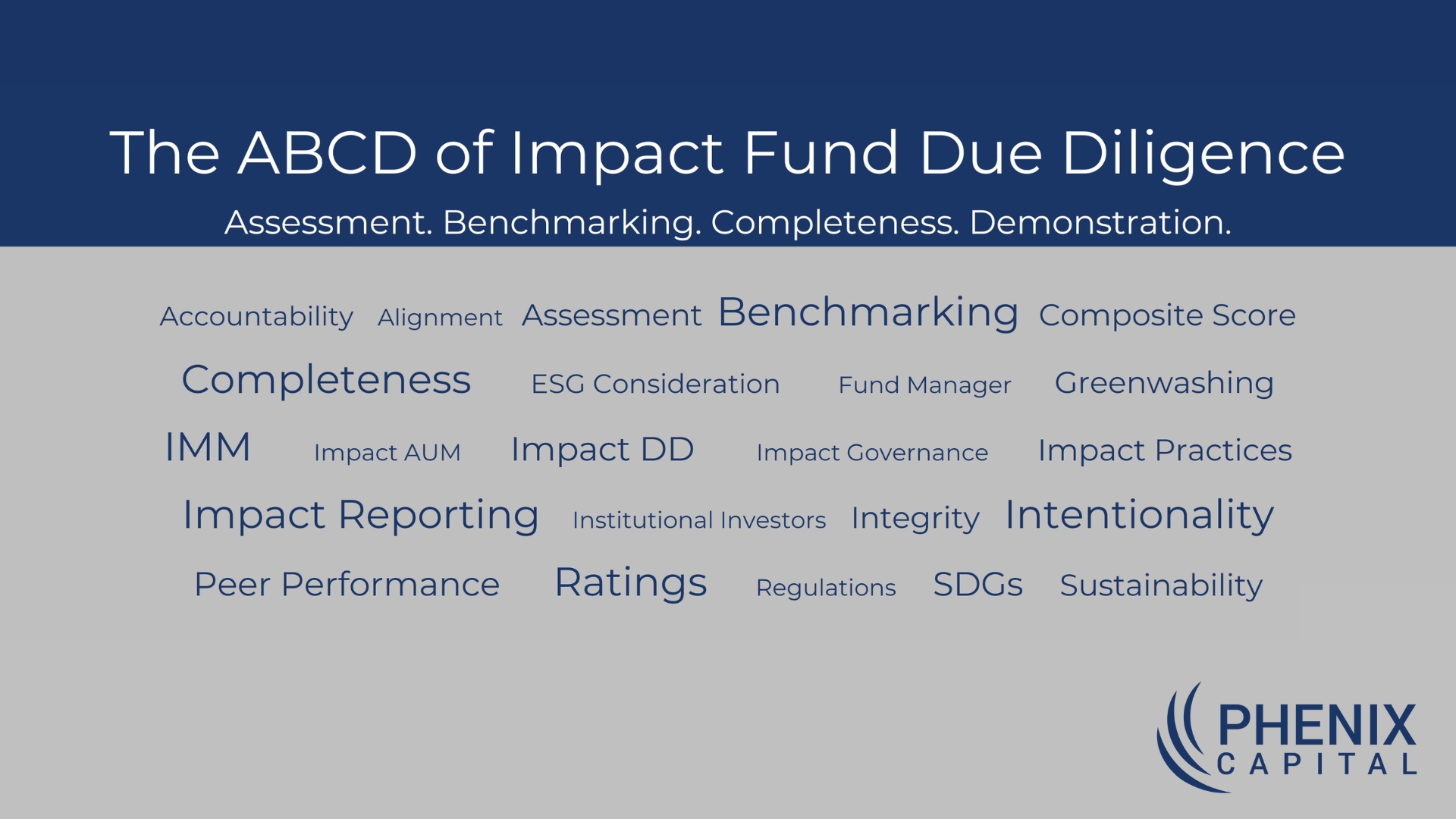

At Phenix, we’ve conducted numerous on-site and desk-based impact due diligence assessments across asset classes and markets on behalf of large institutional investors. Drawing from this experience, we developed the Four Faces of Impact—a matrix designed to classify managers through a comprehensive assessment of their funds.

A Deep Dive into Fund Manager Archetype

These four archetypes of fund managers are designed to classify them at a specific point in time. As managers often oversee multiple funds, their classification may vary depending on the specific fund being evaluated. While many managers aspire to be Impact Champions, the reality exist along a spectrum. In our experience, we often encounter The Silent Impact Achievers, The Impact Learners, and the Impact Illusionists — each on their own unique impact journey.

The Four Faces of Impact.png?width=472&height=472&name=Untitled%20design%20(33).png)

Impact Risks Across the Matrix

This classification of fund managers also offers insights into impact risks. The Five Dimensions of Impact defines impact risk as the likelihood that impact will be different than expected and classifies it into ten types—such as risks related to the strength of evidence and the extent to which community needs are considered. In our experience, the probability of impact risks – such as evidence risk - increase as we progress from Impact Champion to Impact Learner or Illusionist on the matrix.

Does storytelling have a role to play in impact reporting? By Matt Ripley, Impact Frontiers

Fund managers often invest significant time and effort into crafting impact reports - largely because, historically, there has been no clear, shared understanding of what ‘good’ impact reporting actually looks like. The result? Reports that often feel more burdensome than necessary for managers and less useful than they should be for investors.

In April 2024, the Impact Performance Reporting Norms were published following an 18-month public consultation led by Impact Frontiers. The Reporting Norms establish a consensus on how asset managers in private markets can report their impact performance to asset owners.

Now being piloted by more than 100 investors worldwide, the process is beginning to reveal what investors actually find most valuable in impact reporting. One perhaps surprising insight: many investors place significant value on case studies - seeing them as a powerful way to bring impact to life and support decision-making.

At the same time, investors are often sceptical of case studies when it’s unclear whether they represent typical performance or have been cherry-picked to showcase only success stories. The Reporting Norms seek to address this tension by providing recommendations to managers about not just what information to include, but also how to present it transparently. That includes clearly disclosing:

This kind of transparency helps case studies resonate with investors, offering a credible and compelling narrative of change that complements other performance disclosures. So, effective storytelling through case studies isn’t in opposition to good impact reporting — it can be an integral part of it, if done well.

The Four Faces of Impact matrix offer a practical lens for navigating the diverse landscape of fund managers. By recognizing these archetypes, investors can prioritize greater transparency and accountability in their impact due diligence, ultimately encouraging managers to strive to become Impact Champions. We believe this will contribute to a future where more fund managers evolve into Impact Champions, making this a norm than an exception.

.png?width=1800&height=300&name=Mohit%20image%20%26%20bio%20(6).png)

.png?width=1800&height=300&name=Daniel%20image%20%26%20bio%20(1).png)

The second in a series of blogs from Belissa Rojas, ESG and Impact Chief, FAM & Gemma Roex, IMM Lead, Phenix Capital Group

The first in a series of blogs from Belissa Rojas, ESG and Impact Chief at FAM & Gemma Roex, IMM Lead at Phenix Capital Group

Read More

Read More